Does Medicare Have to Pay for Repairs on My Powerchair if the Same Problem Needs Repairs Again

If y'all're a Medicare casher, yous know that health care costs can quickly add upwardly. These costs are particularly noticeable when you're on a fixed income. If your monthly income and full assets are under the limit, yous might exist eligible for a Qualified Medicare Beneficiary plan, or QMB. Below, we'll explicate all you lot demand to know about what the QMB program pays for, who's eligible, and how to sign upward.

Qualified Medicare Beneficiary Plan

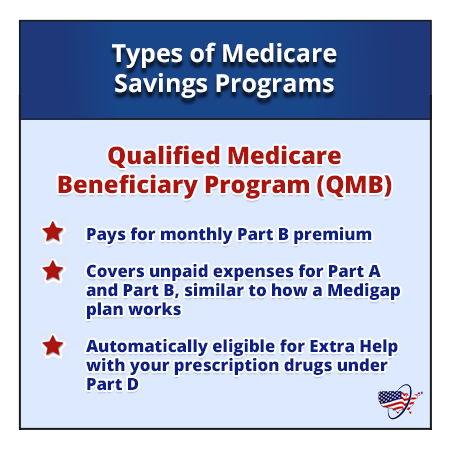

The Qualified Medicare Beneficiary program is a type of Medicare Savings Programme (MSP). The QMB program allows beneficiaries to receive financial assist from their land of residence with the costs of Medicare premiums and more.

A Qualified Medicare Beneficiary gets regime help to cover health care costs like deductibles, premiums, and copays. Recipients must meet all criteria to qualify for the program assist.

The QMB program pays:

- The Office A monthly premium (if applicable)

- The Office B monthly premium and annual deductible

- Coinsurance and deductibles for health care services through Parts A and B

If you're in a QMB program, you lot're also automatically eligible for the Extra Help program, which helps pay for prescription drugs.

Who is Eligible for a Qualified Medicare Casher Program in 2022?

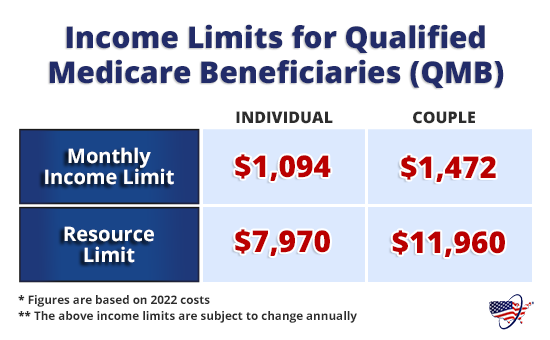

To be eligible for a QMB program, you must qualify for Office A. Your monthly income must be at or below $1,153 every bit an individual and $1,546 as a married couple. Your resources (money in checking and/or savings accounts, stocks, and bonds) must not total more $8,400 as an individual or $12,600 equally a married couple.

Keep in mind that income and resources requirements for the QMB plan are subject to increase each twelvemonth. Thus, members must become through a redetermination to proceed receiving benefits for the following year. This process includes providing your local Medicaid part with updated information about your monthly income and total resource.

If someone doesn't accept Office A only is eligible, they tin choose to sign up someday throughout the year. Once they've signed up for Office A, they can proceed to use for the QMB program. If they need to pay a premium for Part A, the QMB program can cover information technology.

Country-Specific Name Conventions for QMBs

In Due north Carolina QMB is called MQB. If you live in Nebraska, Federal QMB is replaced with total Medicaid.

How to Utilise for a Qualified Medicare Beneficiary Program

Anyone interested in applying for a QMB program must contact their state'south Medicaid office. If your income is higher than the QMB requirements, you should still reach out to decide eligibility.

Each country's Medicaid program pays the Medicare cost-sharing for QMB plan members. Anyone who qualifies for the QMB program doesn't have to pay for Medicare cost-sharing and can't be charged past their health care providers.

If an individual is considered a QMB Plus, they run into all criteria for the QMB program but likewise meet all financial requirements to receive total Medicaid services. These enrollees tin can receive benefits through the QMB program as well as their land'due south wellness programme.

The first stride in enrollment for the QMB program is to find out if yous're eligible. A quick and piece of cake mode to do this is to call your local Medicaid office. The side by side step is to complete an application. You can asking Medicaid to provide you with an application form or locate a QMB plan awarding from your state online.

Billing Requirements for the Qualified Medicare Beneficiary Programme

Providers tin can't bill QMB members for their deductibles, coinsurance, and copayments considering the country Medicaid programs embrace these costs. At that place are instances in which states may limit the amount they pay health care providers for Medicare toll-sharing. Even if a country limits the amount they'll pay a provider, QMB members still don't have to pay Medicare providers for their health care costs and information technology'south against the law for a provider to ask them to pay.

If Your Provider Charges You and You're in the QMB Program

Inform who is requesting payment that you're in the QMB programme. If y'all've already paid, you're entitled to a refund.

To ensure this does non happen, show your QMB card or Medicare and Medicaid card to your providers each time you receive intendance. Your Medicare Summary Notice (MSN) can also serve as proof that you lot're in the QMB program. You tin access your MSN electronically through your MyMedicare.gov account.

If a provider continues to bill you, call Medicare'south price-free number. They will ostend your QMB status and request cessation of billing and/or refunds from your provider(southward). In the example that debt collectors wrongly pursue payment, you can submit a complaint to the Consumer Financial Protection Bureau (CFPB) online or via telephone.

Qualified Medicare Casher Programs and Medicare Advantage

If you're currently in the QMB plan, you can enroll in a Medicare Advantage plan. There are unique plans for those with Medicare and Medicaid. A Medicare Advantage Special Needs Program for dual-eligible individuals could be a fantastic selection. Generally, there is a premium for the plan, simply the Medicaid programme volition pay that premium.

Many people choose this extra coverage because it provides routine dental and vision care, and some come up with a gym membership. While not every policy has these benefits, at that place may be one bachelor in your expanse!

Do I Need to Enroll in a QMB Program if I Have Medigap?

Medigap coverage isn't necessary for anyone on the QMB plan. This program helps you avoid the need for a Medigap plan by profitable in coverage for copays, premiums, and deductibles. Those that don't qualify for the QMB program may find that a Medigap plan helps brand their wellness intendance costs much more anticipated.

- Was this article helpful ?

- Yes (10)No

How to Go Boosted Coverage with Your QMB Program

If you qualify for a QMB programme, you'll save money on out-of-pocket Medicare costs. For further savings, y'all can add supplemental coverage to your Original Medicare.

Pairing an Advantage Special Needs Plan with your QMB is a great way to protect yourself from unexpected health costs. It also provides extra benefits at an affordable price.

Call the number above to get charge per unit quotes for plans in your area. Some other option is to fill out our course to compare rates. An agent will reach out to yous with quotes from superlative-rated carriers.

Enter your zip code to pull plan options available in your area.

Select which Medicare plans you would like to compare in your area.

Compare rates side past side with plans & carriers bachelor in your surface area.

stricklandhourson.blogspot.com

Source: https://www.medicarefaq.com/faqs/qualified-medicare-beneficiary-program/

0 Response to "Does Medicare Have to Pay for Repairs on My Powerchair if the Same Problem Needs Repairs Again"

Post a Comment